AI-Powered Asset Management: From Experimentation…

This study examines the evolving landscape of the fuel distribution sector in Europe, focusing on the impact of energy transition and regulatory changes by 2050.

By 2050, two out of three gas stations in Europe could disappear.

This dramatic decline is being driven by several major shifts: the rise of electric vehicles, the planned phase-out of internal combustion engines, and a profound transformation in how people use and experience mobility. Together, these trends are steadily eroding the profitability of the traditional gas station model.

Yet, behind this projected decline lies a strategic opportunity: to reinvent gas stations as hubs for energy and mobility services. Tomorrow’s stations will be more connected, more local, and more sustainable. They won’t just distribute fuel, they’ll deliver services, experiences, and new forms of value.

This study provides a unique, data-driven projection of the transformation ahead, looking out to 2050. It also outlines concrete strategies for legacy players - including operators, oil companies, fuel distributors, and local governments - to adapt and thrive.

To map out how Europe's gas station network could evolve, we built a model based on actual fuel consumption data by country. Our approach rests on three main pillars:

By cross-referencing these datasets, we projected how total fuel demand is likely to change year by year across Europe. Linking this demand to the average volume sold per station allowed us to estimate how many stations might remain in each country by 2050.

This method provides a nuanced view of the transition, incorporating growing EV adoption, changes in mobility behavior, and improvements in energy efficiency. It also reflects national specificities.

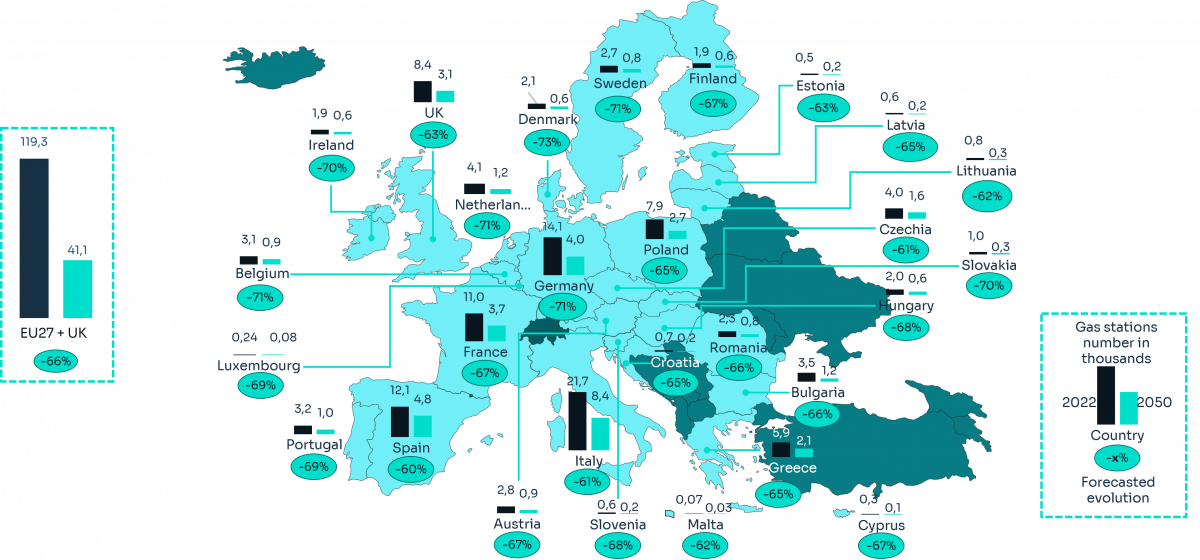

In our central scenario, which aligns with the European Green Deal and Fit for 55 targets, the number of gas stations in the EU-27 plus the UK is projected to decrease from 120,000 today to 41,099 by 2050, representing a 66% reduction.

Stations in rural or low-traffic areas will be the first to feel the impact of declining volumes. In contrast, stations in urban areas or those offering a wider range of services will be more resilient.

To test the robustness of our model, we also explored an alternative scenario in which the EU’s planned ban on internal combustion vehicle sales is delayed from 2035 to 2040. Belgium, a country at the forefront of electrification, served as a test case.

Results for Belgium:

Results for France:

As station volumes decline, operators will need to reinvent their business models along four key dimensions:

Managing Director, Energy, Utilities and Environment | Paris

Jean-Baptiste joined the company as a junior consultant in 2009 after completing his studies at CentraleSupélec and ESCP Business School.

Linkedin Email contact jean-baptiste.hecquet@sia-partners.com