AI-Powered Asset Management: From Experimentation…

Improving SAIDI and SAIFI has become a strategic imperative for Distribution System Operators (DSOs) seeking to deliver world-class reliability in an increasingly complex and climate-exposed energy landscape.

Electricity Distribution System Operators (DSOs) play a vital role in ensuring the reliability and efficiency of power supply to millions of customers worldwide. Two key metrics are used to assess their performance: the System Average Interruption Duration Index (SAIDI) and the System Average Interruption Frequency Index (SAIFI). These indicators measure the average duration and frequency of power interruptions, respectively, providing valuable insights into the reliability of power distribution networks.

SAIDI and SAIFI are critical for regulatory compliance, operational efficiency, and customer satisfaction. High values indicate frequent and/or prolonged outages, which can severely impact both economic activity and customer trust. Thus, reducing SAIDI and SAIFI is a top priority for DSOs seeking to improve their service quality and resilience.

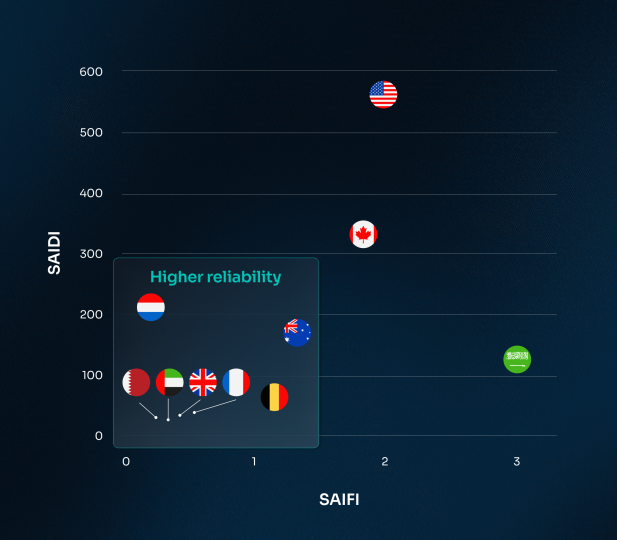

Sia has recently produced a benchmark study of DSO performance across multiple countries, including Australia, Canada, USA, France, Netherlands, UK, Saudi Arabia, Qatar and UAE. It reveals significant variability in SAIDI and SAIFI values and several key trends emerge:

Note that PG&E in California has one of the highest SAIDI values globally, driven by frequent wildfires, hence causing grid shutdowns. In contrast, DEWA in the UAE maintains a very low SAIDI of just 1.6 minutes, showcasing world-class reliability.

Based on the benchmark, the following illustration shows a comparative view of average SAIDI and SAIFI values across key countries, highlighting their relative grid reliability.

The plotted values are based on an average of SAIDI and SAIFI data collected over multiple years to smooth out anomalies. For each DSO, data from 2020–2022 was used, with the exception of:

To derive the national average, the approach involved first calculating the 3-year average per DSO, then averaging those DSO results to produce a country-level score. This method ensures a balanced and time-weighted comparison while highlighting the most consistent performers and outliers across regions.

Based on the best global practices, DSOs can adopt a combination of infrastructure, technology and regulatory strategies to enhance network reliability.

In regions prone to extreme weather, such as the US and parts of Asia, robust infrastructure is crucial for minimizing service disruptions. Investing in advanced, weather-resistant materials and systems, including comprehensive grid modernization initiatives, can significantly mitigate the impacts of environmental stressors.

Technological advancements have transformed the operational capabilities of DSOs, introducing efficiencies that were previously unattainable. Real-time data analytics, when integrated with grid operations, enable proactive management and swift resolution of potential disruptions

Effective regulatory frameworks are instrumental in fostering innovation and ensuring the adoption of best practices in DSO operations. Countries with strong regulatory oversight, such as Belgium and the UK, have performance-based financial incentives to reward DSOs that improve SAIDI and SAIFI. Market-based mechanisms such as dynamic pricing and demand response programs can align consumer behavior with grid efficiency goals.

An additional strategic pillar for DSOs involves enhancing climate resilience, implemented at both national and regional levels. This includes:

Strategies like grid reinforcement or Active Network Management deliver strong performance but require significant investment and a high level of infrastructure or technological maturity. Underground cabling offers considerable impact on reliability, although comes with high costs and longer implementation timelines. In contrast, options such as automated reclosers or demand response programs enable quicker, lower-cost gains, making them suitable for DSOs seeking more agile improvements.

However, the best strategy will vary depending on each DSO’s maturity level, regional challenges, and its investment capacity. Therefore, this reinforces that no one-size-fits-all solution exists for reliability improvement.

These countries already benefit from a high level of grid reliability and a large share of underground infrastructure, especially in urban areas. However, aging infrastructure and climate uncertainties require continued investment.

The region features modern infrastructure, high underground cable ratios, and extreme climatic conditions such as sandstorms and floods.

DSOs face wide-ranging environmental challenges, from wildfires in California to ice storms in Quebec and operate aging, overhead-heavy infrastructure.

Australia combines remote grid operations, bushfire exposure and a high proportion of overhead lines. Urban reliability is generally high, but rural regions experience more difficulties.

The path to reducing SAIDI and SAIFI is not one-size-fits-all: it requires thoughtful and tailored strategies in operational realities, geographic challenges and technological maturity. While numerous interventions exist, certain strategic pillars have consistently delivered meaningful improvements across global DSOs.

Firstly, technology remains a crucial enabler. Solutions like Advanced Metering Infrastructure (AMI) and Advanced Distribution Management Systems (ADMS) not only enhance outage detection and resolution but also build the foundation for more flexible and data-driven networks. These technologies unlock real-time insights and automation that are essential for managing daily operations and unexpected crises.

Secondly, infrastructure modernization is a long-term investment with high returns. Whether it's reinforcing substations or increasing the underground cable ratio, modernizing assets can significantly enhance reliability, particularly in regions exposed to harsh climate or aging grid components. While undergrounding is costly, its benefits in urban or high-risk areas often outweigh the investment.

Finally, resilience planning must be embedded across the organization, from operations to strategy. The increasing frequency of extreme weather events makes it critical for DSOs to adopt proactive risk mitigation measures, such as wildfire prevention infrastructure, flood-resistant systems and vegetation management. These strategies reduce outage risk and enhance service continuity.

What stands out across leading DSOs is the presence of advanced tools but also the ability to integrate them in a unified and future-focused grid management approach. For DSOs and policymakers, the goal should be to create a culture of innovation, backed by regulatory frameworks that incentivize performance improvement and grid flexibility.

For the public, this means fewer outages, quicker recovery times and a grid that evolves with the growing demands of electrification, climate change and digital transformation. For DSOs, it means seizing the opportunity to transition from reactive operators to proactive energy enablers.

Partner, Energy & Transportation | Brussels

Benoit is the head of the Energy & Transportation business unit at Sia Belgium in which he gained a deep knowledge in the different value chains. Through his different projects, he has developed managerial and analytical skills while increasing the business of Sia Partners Belgium.