AI-Powered Asset Management: From Experimentation…

The fifth edition of the global non-life insurance benchmark assessing the digital customer journey for prospects across Europe, the Middle East, Asia, and Australia, highlighting how digitalisation and AI are transforming insurance and redefining the path to new clients.

For the fifth year in a row, Sia conducts its Global Insurance Customer Journey Benchmark, providing an in-depth analysis of the digital experiences offered by 110 insurance companies across 13 countries. This comprehensive study focuses on the perspective of non-clients, evaluating how easily prospects can insure a car or home product through a mobile website or application.

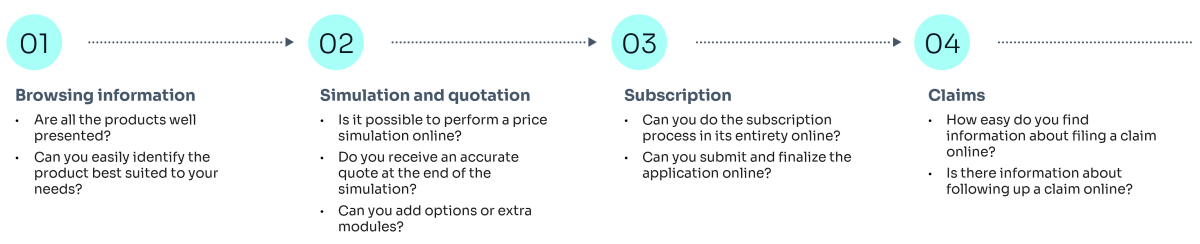

The assessment covers each step of the customer journey—browsing information, simulating coverage options, obtaining quotations, and completing online subscriptions—as well as the ability to file and track claims digitally. Beyond usability, the benchmark places strong emphasis on accessibility, ESG (Environmental, Social, and Governance) practices, and the integration of artificial intelligence (AI). Together, these factors paint a detailed picture of how insurers are adapting to new digital expectations, highlighting the growing importance of intelligent, inclusive, and responsible design in shaping tomorrow’s insurance landscape. Our worldwide Global Insurance Customer Journey Benchmark is a yearly exercise, and the criteria evolve year-on-year, incorporating the newest trends and innovations, and moving with customer expectations.

The global results of the benchmark reveal a dynamic and increasingly diverse landscape. Australia leads the market once again, closely followed by the Netherlands, Singapore, and the UK, reflecting their strong digital offerings and mature customer journeys. Japan, newly included in the study, closes the top 5. France and Belgium sit in the mid-tier, where scores vary significantly, having insurers at the forefront of digital innovation alongside less advanced players. Both countries are advancing in digital maturity – especially in subscription, now offered by an increasing number of insurers. Hong Kong distinguishes itself with substantial subscription capabilities, setting it apart from regions such as Italy, the Middle East, and Luxembourg.

The top 10 insurers are now noticeably more geographically diverse than last year. While the previous edition was largely dominated by Australian companies, this year’s ranking showcases leading players from around the world, reflecting the global emergence of fully digital insurance experiences. AXA Belgium retains first place, showing its consistent leadership in digital maturity. NRMA Insurance from Australia holds second place, maintaining strong market performance. Belfius Direct from Belgium takes third, while FWD from Singapore rises to fourth, marking significant progress compared to last year. ANWB from the Netherlands rounds out the top five, completing a top tier that spans multiple countries and digital approaches.

A key factor in this evolution is the growing role of artificial intelligence (AI). AI manifests through advanced chatbots, automated data verification with tools like Google Earth, and risk or premium estimation, enabling an AI agent to guide prospects through the insurance journey in a seamless and fluid manner. As digital channels become increasingly central, the arrival of AI agents promises to profoundly transform how prospects discover, subscribe to, and manage insurance, setting new benchmarks for efficiency, personalization, and user experience.

Sia leverages findings from this benchmark to empower insurers in refining their digital strategies. With a global understanding of customer journeys, combined with insights into current trends and future shifts, we don’t just offer advice — we provide a roadmap for navigating the complex digital landscape.

By aligning with evolving customer behaviors and expectations, Sia ensures that insurers stay competitive and innovative. Our holistic support helps businesses reshape their digital approach, fostering long-term growth and improved customer experiences in the insurance industry.

Partner, Insurance | Paris

Pierre implements and oversees a wide range of projects with global and national (re)insurers, all across the value chain from point of sale to 2nd and 3rd lines of defense. He is committed to bringing the support and confidence of the firm to help businesses thrive in the new transformative age.

Partner, Banking, Insurance and Actuarial Services | Benelux

Anthony is a Partner in our Financial Services practice. He leads Banking, Insurance and Actuarial activities to help our clients and consultants accelerate their projects and drive future-forward, sustainable impact and competitive advantage.