AI-Powered Asset Management: From Experimentation…

Amidst the urgent imperative to decarbonize a rapidly growing aviation sector, Sustainable Aviation Fuels (SAF) are emerging as the most mature, scalable, and immediately deployable solution.

Aviation is responsible for approximately 2.5% of global CO₂ emissions today—but its share is poised to grow dramatically. Air traffic is forecasted to increase by 4.2% annually through 2040, while pressure mounts from international regulators, climate investors, and consumers for the sector to align with net-zero targets. Amid this growing urgency, Sustainable Aviation Fuels (SAF) have emerged as the most mature, scalable, and immediately deployable decarbonization lever.

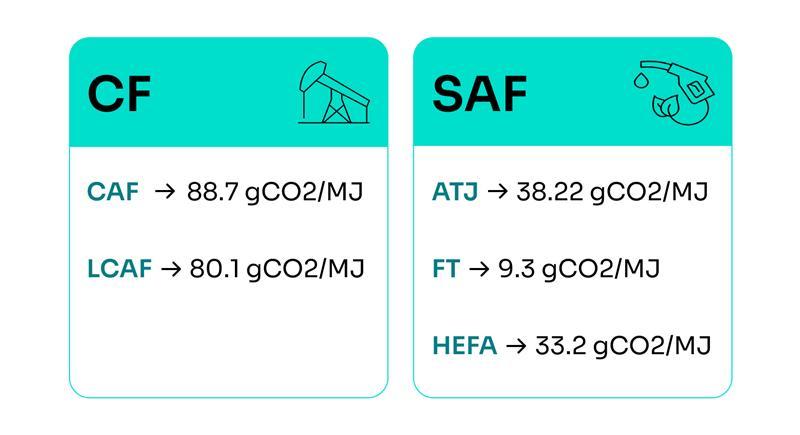

SAF are produced from renewable feedstocks—such as used cooking oil, municipal waste, or algae—and can reduce lifecycle emissions by up to 90% compared to conventional jet fuel (CAF). Importantly, SAF are compatible with existing aircraft engines and fueling infrastructure, allowing immediate integration without technical disruption.

Global institutions have acknowledged SAF’s critical role. According to IATA, SAF could deliver 65% of the total CO₂ reduction required to meet aviation’s 2050 net-zero target. Likewise, ICAO’s CORSIA scheme and the EU’s Fit for 55 package have positioned SAF at the core of climate compliance for the aviation sector.

SAF is not a single solution—it encompasses multiple production technologies and feedstock pathways. As of 2024, 11 ASTM-certified pathways exist, with three leading technologies at the forefront of commercial deployment:

Production is expected to reach 16.4 billion liters by 2026, up from just 3.2 billion liters in 2022—a strong but insufficient trajectory considering the 449 billion liters needed annually by 2050. Bridging this gap will require accelerated deployment, diversified feedstock access, and significant capital investment.

Despite its climate benefits and technical readiness, SAF’s adoption is hindered by economics. The cost differential between SAF and CAF remains significant.

Reference: Indicative estimates based on International Civil Aviation Organization (ICAO) & International Air Transport Association (IATA) & (IEA)

Each production pathway has a distinct cost structure:

According to our findings, current SAF is 2 to 4 times more expensive than fossil jet fuel. This results in a higher cost burden on airlines and potentially, passengers—unless mitigated through subsidies, tax credits, or regulated blending mandates.

To quantify the impact of SAF integration on passenger costs, Sia developed a proprietary cost simulation model based on realistic operational inputs:

Assumptions:

To estimate the cost impact of SAF, Sia built a pricing model based on realistic airline operations. The analysis assumes a 5% SAF blending ratio, in line with short-term regulatory targets.

It also assumes that 100% of the additional fuel cost from SAF is passed on to passengers through ticket prices.

Findings:

Under these conditions, short and long-haul flights see a 1% increase, while medium-haul flights face up to a 4% rise. This reflects the higher fuel cost sensitivity of medium-haul routes.

These results show that modest SAF incorporation rates have limited consumer impact. However, as incorporation ratios scale up, airlines will face more difficult trade-offs without cost-sharing mechanisms or subsidies.

The momentum behind SAF is accelerating worldwide. Leading regulatory initiatives include:

To close the production gap, $1.5 trillion in investment will be needed across the SAF value chain by 2050. Meeting demand will require:

Sustainable Aviation Fuels represent the aviation sector’s most actionable tool for near-term decarbonization. Despite high costs and limited availability, SAF delivers a powerful combination of certified safety, compatibility, and emissions reductions.

What’s needed now is collective acceleration: through innovation, investment, and strong policy alignment. The path to net zero in aviation runs through SAF, and while the flight path is steep, it’s the only one that leads to a sustainable landing.

Managing Director, Energy, Utilities and Environment | Paris

Jean-Baptiste joined the company as a junior consultant in 2009 after completing his studies at CentraleSupélec and ESCP Business School.

Linkedin Email contact jean-baptiste.hecquet@sia-partners.com