AI-Powered Asset Management: From Experimentation…

Embedding sustainability into private equity is no longer optional, it is a strategic imperative that drives value, resilience, and long-term competitiveness across the investment lifecycle.

Sustainability is integral to private equity strategy, driving value creation, strengthening risk management, and meeting the demands of heightened stakeholder scrutiny. As regulatory mandates proliferate and limited partners (LPs) set a higher bar, PE firms are rethinking how sustainability is embedded across the investment lifecycle. This evolution goes beyond compliance or disclosure; it reflects a broader recognition that environmental, social and governance considerations influence performance, resilience and long-term competitiveness. In today’s complex and often polarized landscape, the challenge is to advance sustainability in ways that are credible, focused and economically grounded.

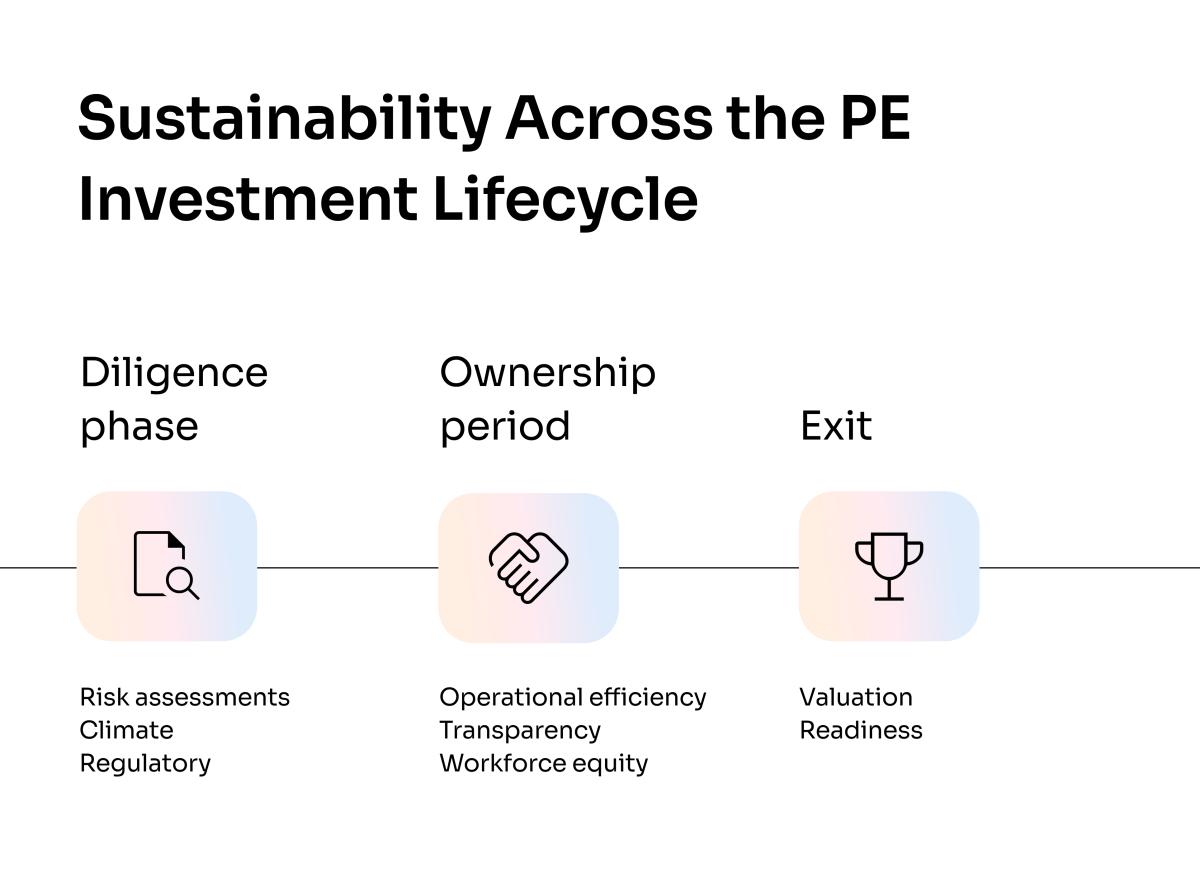

Sustainability considerations influence decisions and shape outcomes at every stage of the investment journey:

Even for seasoned investors, integrating sustainability at scale remains challenging.

Portfolio companies, too, face rising demands around sustainability. Many lack dedicated teams, mature systems or the internal capacity to respond. Yet they are increasingly expected to disclose performance, even when not directly subject to regulatory requirements as customers, capital providers, and regulators converge on transparency. At the same time, growth targets, cost pressures, and compliance obligations require sustainability to be embedded in core operations rather than treated as an add-on. Compounding this are hidden or underestimated risks, ranging from climate exposure and labor conditions to third-party reputational vulnerabilities.

Forward-leaning PE firms are responding with pragmatic, scalable strategies:

Navigating sustainability in private equity requires intention, clarity and alignment with strategic priorities. Success lies in developing solutions that respond to external scrutiny without losing sight of core value drivers. At Sia, we work with GPs and portfolio companies to identify the right sustainability levers, design replicable models and turn ambition into execution. We provide end-to-end support from strategy and implementation to measurement and disclosure. Our proprietary SiaGPT GenAI-enabled tools simplify the complex, powering sustainability due diligence, benchmarking, gap and readiness assessments, and more.

In a dynamic landscape, a strong sustainability strategy can be more than an obligation. Done right, it becomes a tool for creating clarity, credibility and enduring advantage.

Managing Director, ESG Strategy & Communications Lead | New York

Judy Sandford is a Managing Director at SiaXperience, part of Sia Partners, leading the ESG Strategy & Communications practice.

Managing Director, Financial Services | Charlotte, NC

Managing Director, Financial Services | Charlotte, NC