AI-Powered Asset Management: From Experimentation…

A study on the current state of mobile banking in the EMEA region, North America, Asia and Australia, and a peek into the future.

Digital transformation is accelerating worldwide, and banking is no exception. Confronted with new technologies and business models, evolving regulatory demands, and shifting customer expectations, banks are compelled to adapt at an ever-faster pace.

Emerging disruptive technologies, particularly artificial intelligence (AI), are reshaping the banking sector by driving automation, strengthening risk management, and enhancing operational efficiency. At the same time, AI enables banks to deliver more personalized and proactive services: predictive analytics can anticipate customer needs, while natural language processing powers advanced chatbots and virtual assistants that provide 24/7 support. As these capabilities mature, banks are embedding AI into their mobile apps to offer tailored financial advice, spending insights, and adaptive product recommendations, making banking more intuitive and engaging.

In parallel with this technology-led innovation, banks remain under scrutiny on Environmental, Social, and Governance (ESG) performance, with regulators and the public assessing whether their initiatives meet growing expectations. Sustained oversight is prompting banks to take a more active role in the sustainable transition and digitalization, particularly through mobile apps, serves as a key channel to showcase ESG progress and empower customers to advance their own sustainability practices.

Building on this broader mandate to deliver responsible, human-centered services, an essential aspect of the digital evolution is ensuring that banking applications are accessible to all users, particularly those with impairments. While the European Accessibility Act and similar regulations worldwide set clear requirements for inclusive digital environments, the push for accessibility is not solely regulatory driven. It is equally user-centric, as banks recognize that accessible design improves the overall customer experience and enables everyone to participate more fully in society.

Bringing these threads together, mobile banking apps have become the primary touchpoint for customers to engage with their banks. To thrive in this digital‑first landscape, institutions must deliver seamless, fully integrated end‑to‑end journeys across a broad range of products and services, alongside streamlined onboarding to attract new clients. To track these innovations, Sia conducts an annual global benchmark of banking apps, identifying the most complete, innovative, and user‑friendly applications worldwide.

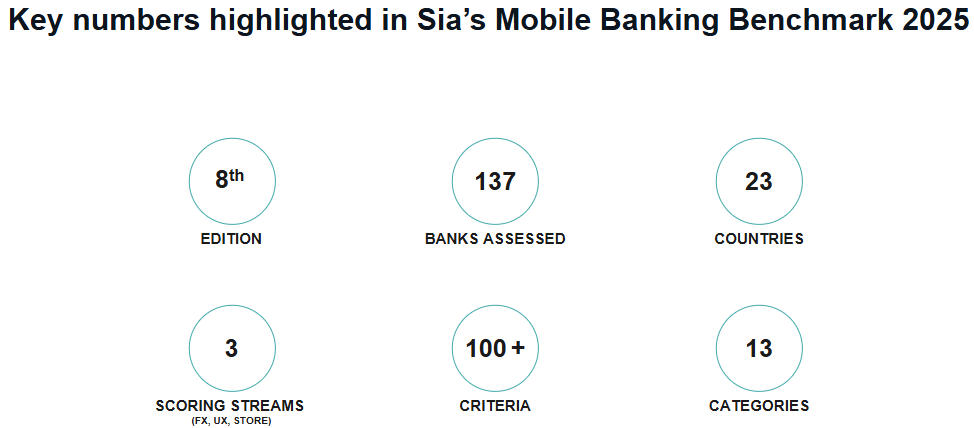

Sia’s 2025 Mobile Banking Benchmark assessed the performance of 137 banking applications in 23 countries across the EMEA region, North and Central America, Asia and Australia. The banks in scope of the study were evaluated on more than 100 criteria in 3 pillars: Functionalities (FX), User Experience (UX), and App Store ratings. Reflecting recent market trends, Sia has identified ESG, Accessibility, and Security as key transformative forces shaping the future of digital finance and introduced dedicated assessment lenses to evaluate their impact on the mobile banking landscape. In parallel, AI capabilities, were embedded into the relevant FX and UX sub-categories.

The Mobile Banking Benchmark methodology, based on the 3 pillars, follows an objective and transparent scoring method. A 4-point scale with customized answer possibilities for each criterion guarantees comparability, transparency, and objectivity across banks.

Our worldwide Mobile Banking Benchmark is a yearly exercise, and the criteria evolve year-on-year, incorporating the newest trends, and moving with customer expectations.

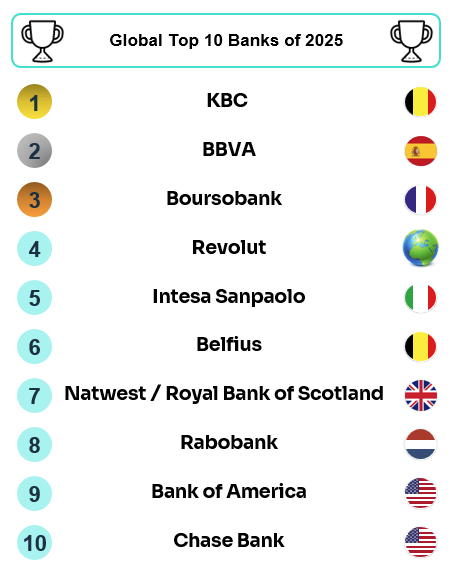

In the 2025 edition, KBC firmly cements its position at the top of the rankings, underscoring its continued strength. Meanwhile, BBVA makes an impressive debut in second place, while Boursobank continues to demonstrate its strength with a solid third-place.

Innovation is critical as Neobanks and FinTechs enter the market with best‑in‑class, digital‑only experiences focused on specific segments of the banking value chain. Yet as the industry navigates these pressures and opportunities, the spotlight remains on mastering Daily Banking Functionalities and the User Experience of Mobile Banking Applications. This year’s results reveal a clear split between breadth and depth: market‑leading traditional banks combine polished everyday journeys with comprehensive product suites, spanning lending, insurance, and investments, and seamless integration across channels, while fast‑moving Neobanks, such as Revolut, excel in core journeys like onboarding, payments, and card controls with clean, intuitive interfaces but tend to lag on end‑to‑end offerings, advisory services, and complex servicing. The competitive edge, therefore, lies in uniting best‑in‑class daily banking and mobile UX with the breadth, integration, and advice that deliver full‑lifecycle value.

Competition at the top is fierce. The global top ten is largely dominated by European and US banks, with Revolut also in the mix. While a core group consistently returns to the leaderboard each year, the order is far from settled: sustained investment in digital and the rapid pace of mobile innovation mean even small, incremental enhancements can tip the balance and move players up the ranks. Challengers and Followers are stepping up their release cadence, sharpening UX optimization, and modernizing their platforms, tightening the race in everyday banking. Meanwhile, Leaders continue to set themselves apart with richer ecosystems, smooth end-to-end digital customer journeys and tighter cross‑channel integration, powered by strong data foundations. They deploy AI for support, personalization, and customization, ensure their applications are compatible with accessibility features to deliver a smooth experience for users with disabilities, and lead on ESG with features like carbon‑footprint tracking, impact reporting, and sustainable product options. By contrast, Laggards still struggle with fragmented journeys, limited mobile features, and inconsistent performance, leading to gaps in basic functionality and a weaker User Experience.

The following ranking displays the Global Top-10 Mobile Banking Apps of 2025:

Partner, Banking, Insurance and Actuarial Services | Benelux

Anthony is a Partner in our Financial Services practice. He leads Banking, Insurance and Actuarial activities to help our clients and consultants accelerate their projects and drive future-forward, sustainable impact and competitive advantage.