AI-Powered Asset Management: From Experimentation…

An updated market study on the use cases, markets and BESS technologies that will contribute to the energy transition.

Stationary storage makes it possible to store large amounts of electricity (up to several MW) over variable durations (from 1 hour to several tens of hours), depending on the applications and technologies.

Energy demand, particularly electricity demand, fluctuates throughout the year and during the day. High consumption peaks are currently mainly balanced by the activation of thermal power plants (gas/oil) and by the use of storage systems such as pumped-storage hydropower (PSH).

PSH is the oldest and most widespread technology to date. However, batteries are playing an increasingly important role, especially with the rapid development of intermittent renewable energies within the framework of energy transition policies.

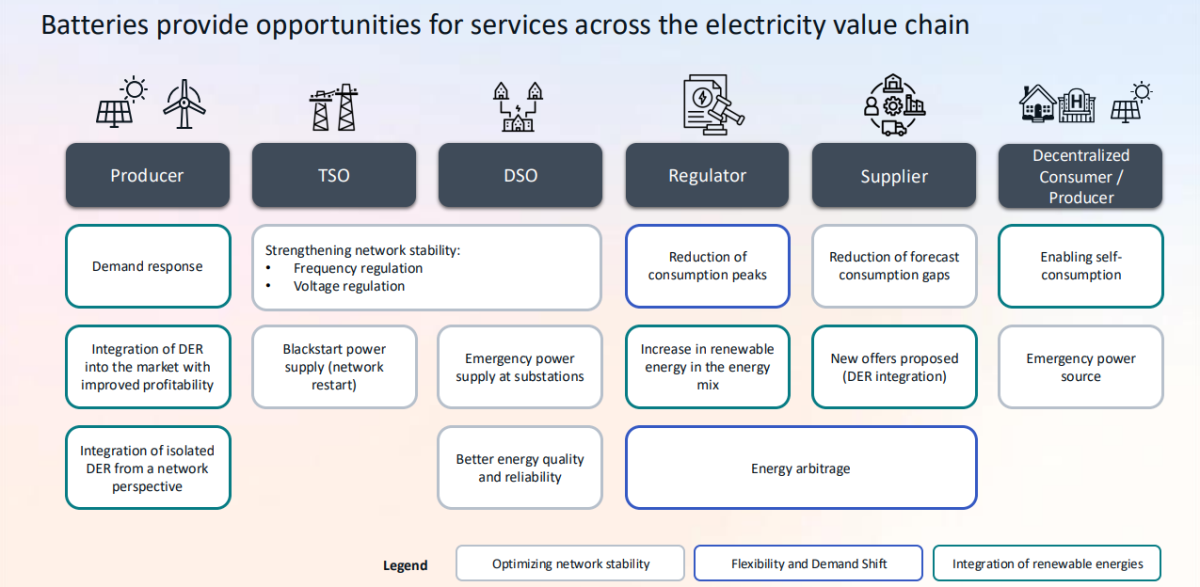

BESS (Battery Energy Storage Systems) play a strategic role in creating a more stable, flexible, and decarbonized power grid, particularly for all stakeholders across the electricity value chain:

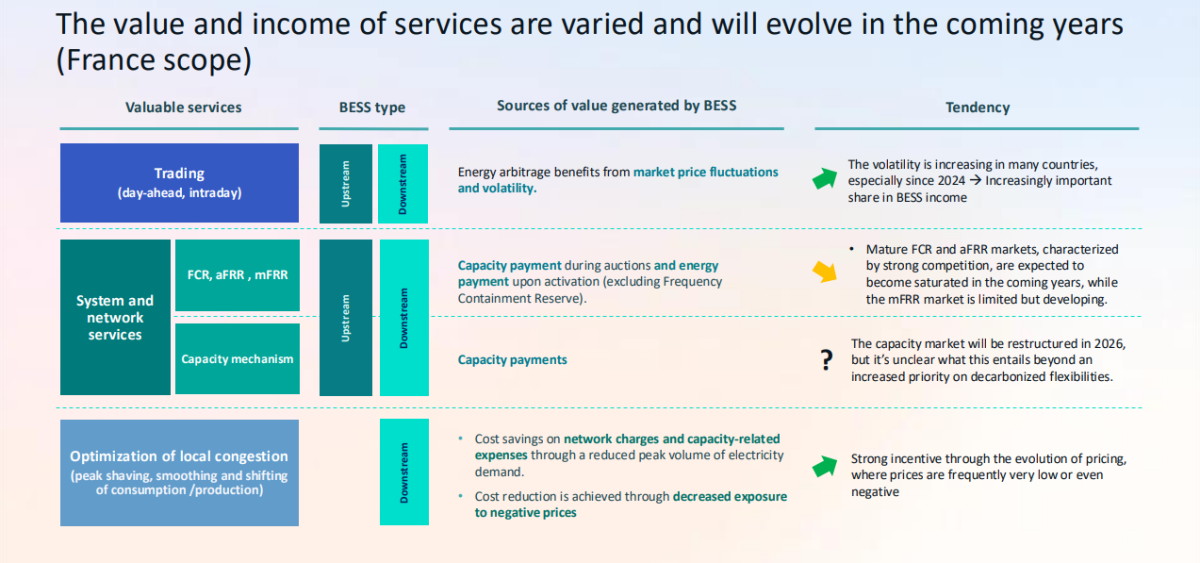

The revenue sources and value streams associated with batteries are diverse, and their share is expected to evolve in the coming years:

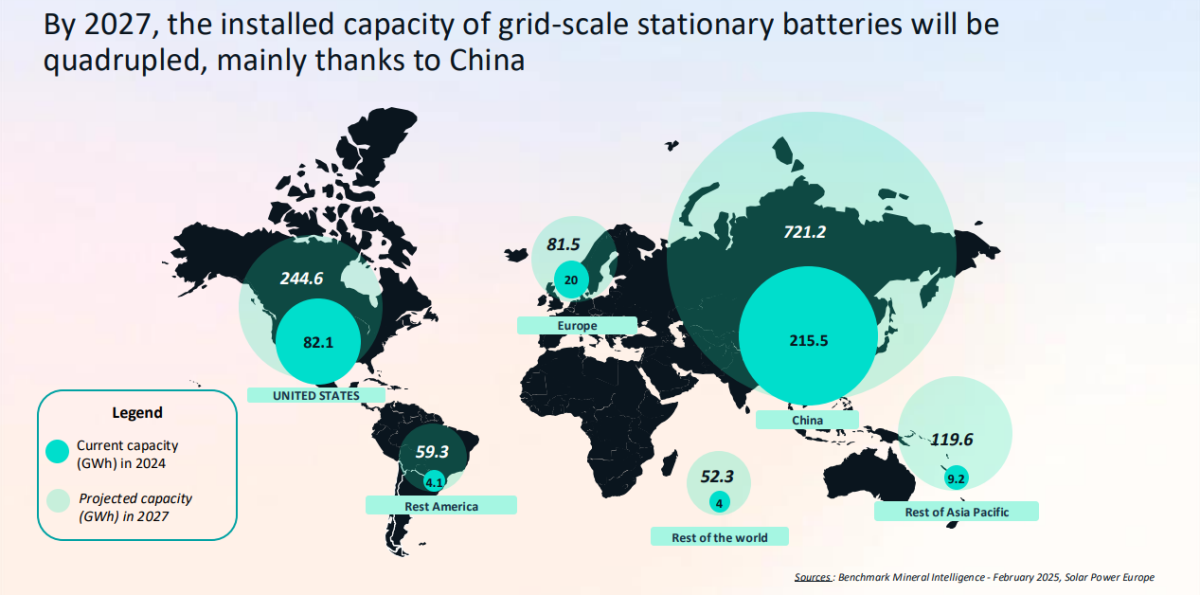

The number of stationary battery energy storage system (BESS) installations is expected to increase significantly over the course of this decade, driven by falling battery costs, supportive public policies, and favorable regulations.

By 2027, the installed capacity of stationary batteries will more than triple, primarily due to growth in China.

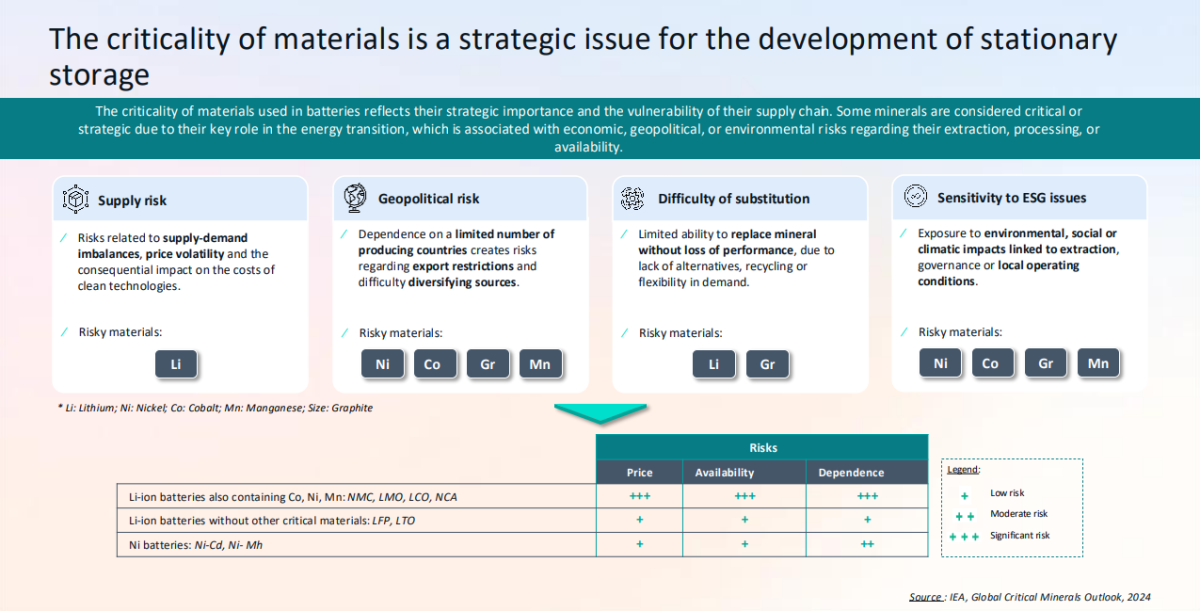

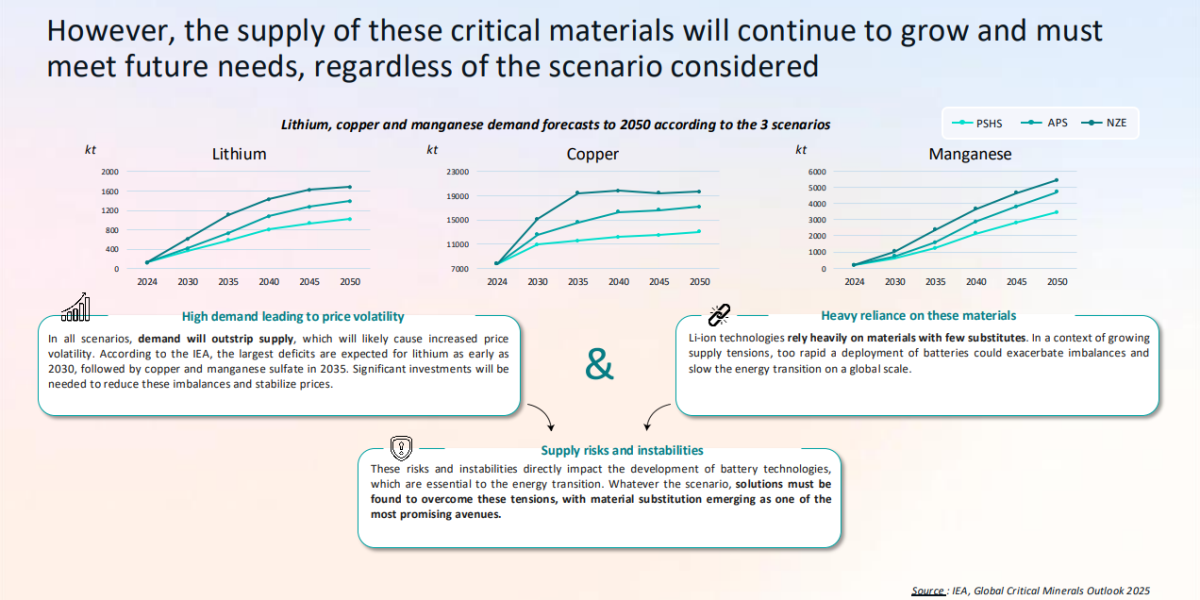

The criticality of the materials used in batteries reflects both their strategic importance and the vulnerability of their supply chain. Certain minerals are considered critical or strategic due to their key role in the energy transition, combined with economic, geopolitical, or environmental risks affecting their extraction, processing, or availability.

Given technological trends and rising demand, a shortage of lithium, nickel, manganese, and cobalt is expected between 2030 and 2035, potentially leading to price instability. This imbalance will mainly affect the electric vehicle market, which is more dependent on these materials, unlike stationary storage, which is less exposed thanks to the use of alternative chemistries.

Therefore:

Recycling and reusing batteries from mobility applications for other uses, such as in energy storage systems, extends their lifespan and optimizes their value. This practice reduces material demand, limits waste, and supports the energy transition — and will become essential.

In addition, diversification with technologies that are less dependent on critical materials is necessary.

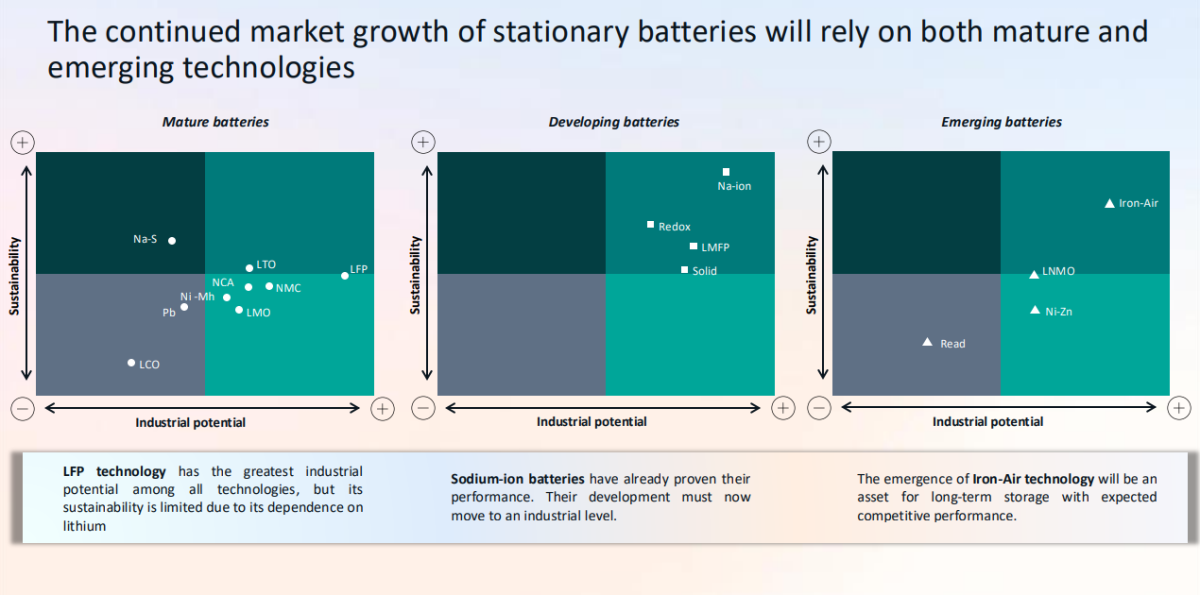

New battery technologies that help reduce reliance on critical and strategic materials are being developed. We propose an analysis of battery attractiveness based on their technical capabilities for industrial use and their sustainability:

Today, LFP technology largely dominates the stationary battery market, thanks to its maturity, safety, and declining costs.

Emerging alternatives such as sodium-ion batteries and redox flow batteries are attracting growing interest. Less dependent on critical materials and offering competitive performance, these technologies are beginning to establish a foothold and are expected to develop alongside lithium-ion batteries in the medium term.

In the longer term, iron-air batteries could stand out due to their low reliance on critical materials and their ability to provide long-duration storage, although they still need to overcome certain technological hurdles.

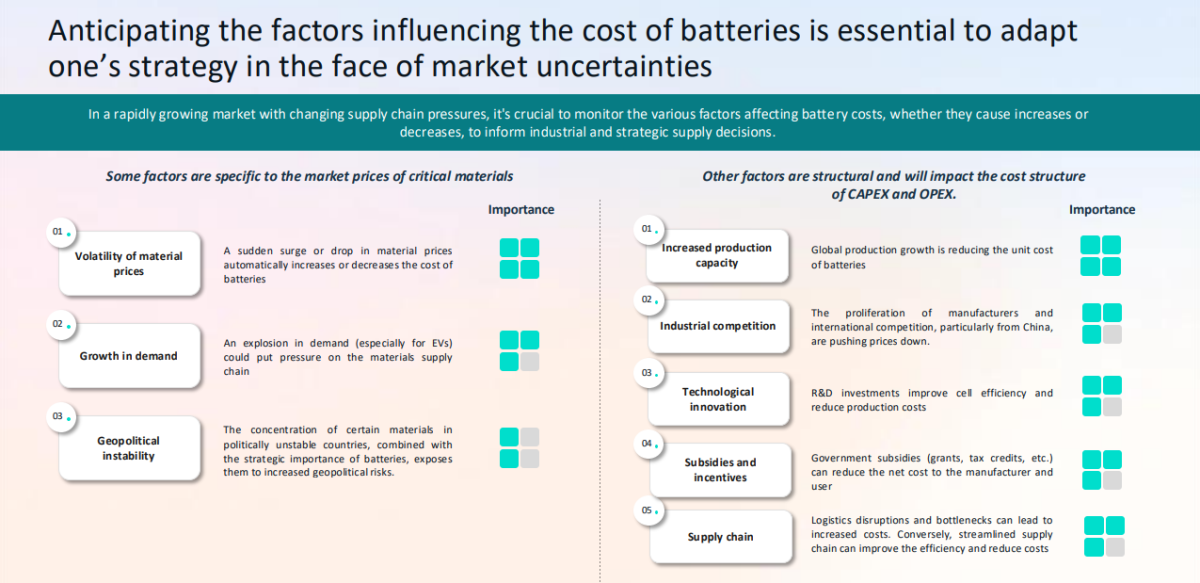

Battery costs are determined by a variety of factors — some driving them down, others likely to push them up. In a context of strong growth and strained supply chains, it is crucial to monitor these dynamics in order to guide industrial and strategic decisions.

Partner Energy | Paris

Sebastien is a Partner in the Energy practice based in Paris. He brings with him more than 25 years of experience in the energy sector, with strong expertise across the entire energy value chain, and a focus on market analysis, strategic positioning, and regulatory frameworks.