Marketing vs. GDPR: Reconciling personal data…

To drive Hong Kong to a New Era of Smart Banking, both banks and Stored Value Facilities (SVF) operators can participate in the Faster Payment System, FPS, which supports the use of mobile phone numbers or email addresses for payments in HKD and RMB anytime and anywhere.

The HKMA announced 7 initiatives to prepare Hong Kong to move into a new era of smart banking, FPS is one of them to be launched in late September 2018.

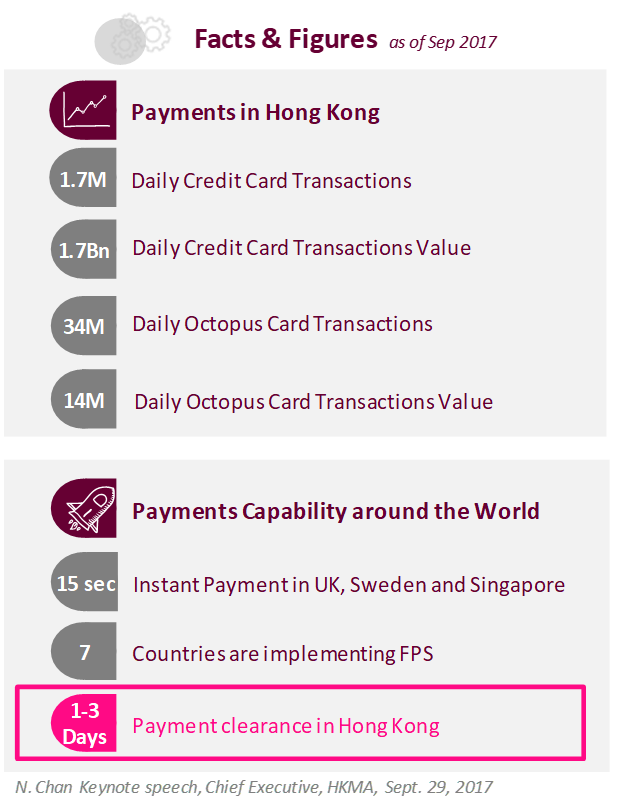

Nowadays, Digitalization and Streamlining Customer Payment Journey is a global trend in banking and payment market. There are rising aspirations and demands from customers, to handle the payment needs that increases every day. Hong Kong, in order to remain competitive against competitors, such as UK, Sweden & Singapore, aims to develop a 7 x 24 x 365 Same Day Payment Service as one of the 7 initiatives of Smart Banking, supported by its mature banking ecosystem and technology capabilities.

In order to fulfill the HKMA purpose of moving Hong Kong into Smart Banking Era, ultimate goals are set up for FPS as below:

To achieve Faster Payments, the existing HKICL Platform has transformed from Daily Batch operations to Real-time services. Allowing different banks to submit payments at any time and responds to the payee bank immediately.

After such transformation, HKICL Payment Platform is now able to provides payment services in Real-time: receive payment instructions from Payer Bank at any time of the day; process payment immediately; and settle payment to Payee Bank immediately.

Banks in Hong Kong are expected to align with the new HKICL Faster Payment Model in order to achieve the requirement that inter-banks payments are to be processed within same day, maintain 7 x 24 x 365 (including non-business day / typhoon / black signal day) service. This include:

To achieve Faster Payments, Banks and SVF Service Providers are to enhance their payments capabilities, from previously Daily Overnight Batch, to Same Day Hourly Batches, ultimately reaches the True Real Time payment processing.

The FPS will facilitate both Personal-to-Personal service (P2P), as well as Personal-to-Merchant service (P2M).

P2P:

P2M:

To implement FPS, we have identified multiple Challenges from Retail and Commercial Banking, across both Traditional and Digital Banking Channels, in order to handle the huge amount of transactions throughout the day, 7 x 24 x 365:

1. Payment Submission in Real-time: The payment submission to HKICL has to become digitalized.

2. Payment Confirmation in Real-time: The banks’ connectivity tool with the HKICL has to align with the new industry standards.

3. Internal Multi channel Process Payments in Real-time: Banks have to enhance the capability on both Traditional and Digital Banking Channels internally.

4. Internal Multi channel Settle Payments in Real-time: Banks have to enhance the capability internally, across multi channels, to settle and reflect the payments in Real-time.

5. New TOM Design & Implement: The operation from receiving customer payment instruction across multiple channels, addressing the payments with relevant customer account profiles, to submit the payments to ICL, are to be transformed into Real-time or Close-to-Real-time operation.